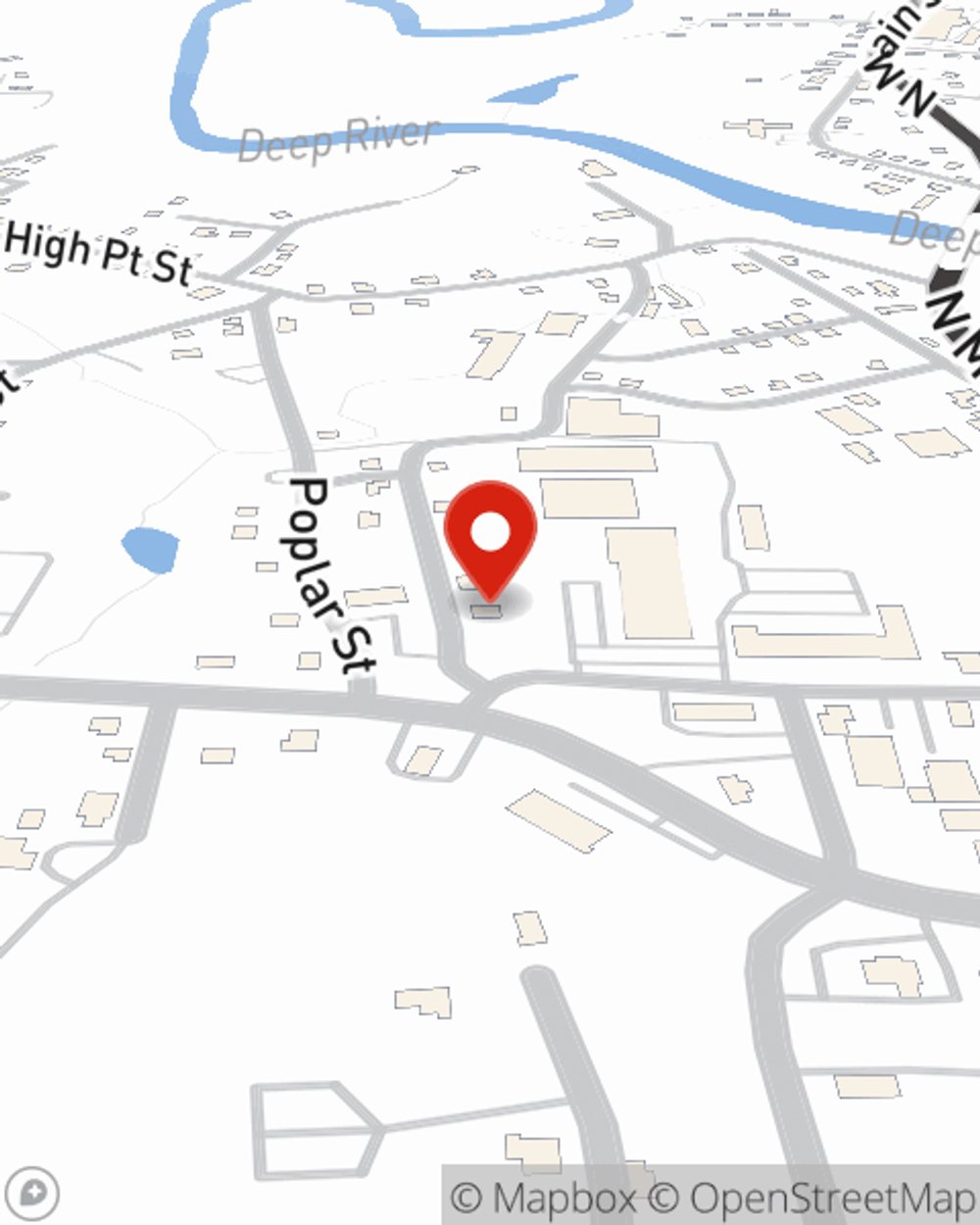

Business Insurance in and around Randleman

One of Randleman’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

Help Protect Your Business With State Farm.

Operating your small business takes time, effort, and great insurance. That's why State Farm offers coverage options like worker's compensation for your employees, extra liability coverage, a surety or fidelity bond, and more!

One of Randleman’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

Get Down To Business With State Farm

Why choose State Farm for coverage? Your fellow business owners have rated State Farm as one of the top overall choices for insurance coverage by small business owners like you. You can work with State Farm agent Sarah Kivett for a policy that protects your business. Your coverage can include everything from a surety or fidelity bond or worker's compensation for your employees to key employee insurance or commercial auto insurance.

Call or email agent Sarah Kivett to discuss your small business coverage options today.

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.

Sarah Kivett

State Farm® Insurance AgentSimple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Sharing the road with farm vehicles

Sharing the road with farm vehicles

Rural driving might be relaxing but these roads are shared with farm vehicles and can have risks. Here are tips to help when driving in rural areas.